What are the brightest and most ambitious minds of our generation currently working on?

- Here is a video from someone who spent 7 months building minecraft inside of minecraft by painstakingly constructing a redstone computer inside of it with its own graphics card and screen

- Here is someone who spent 5 years constructing a 3D game within a 2D geometry game by building primitives and constructing 3D illusions from them

- Here is a video from someone who spent 6 months building a factory inside factorio which recursively self-expands using a lua script

- And here is someone who spent 4 months building a shader to let the linux kernel run inside of VRchat via writing a RISC-V CPU/SoC emulator in an HLSL pixel shader

I find the above examples fascinating from the meta perspective: while there’s nothing wrong with having fun building inside of games, these are the very same skillsets which tech companies would pay six figures to have on their side! (of course they may enjoy the games more – this is discussed later)

Sometimes people of this caliber even have trouble finding a job – they often don’t really know where to go besides apply online to boomer companies who reject them when they see a lack of credentials. They love building things and are very smart and hardworking, but their milieu is an environment which captured them from a young age (often a video game or social media) and sometimes also ensured that the value they produce is within a pre-existing platform (e.g. a video game).

“Why did you cherry-pick people playing video games instead of talking about, like, everyone currently enrolled in medical school or something?”

The US currently has 125,000 students enrolled in medical school (this seems low to me but I checked several sources). Minecraft has 140,000,000 (1120x) monthly active users. Roblox has 200,000,000 (1600x). This is obviously an unequal comparison, but the magnitude of the difference is still staggering.

Why are you building a graphics card inside minecraft instead of inside nvidia?

There’s several reasons why someone might build a graphics card inside of minecraft rather than being paid $300,000 a year to build one inside of nvidia:

- Minecraft is more enjoyable

- Minecraft is more addictive

- Minecraft found them first

- They don’t know the latter option exists, or how they would do it, or think they’d fail at it

The first reason (that minecraft is more enjoyable than working for nvidia) applies to most people who are playing games instead of working, and instead the latter three reasons will be the focus of the following sections.

Addiction & Adolescence

The world has a lot of addicting products. Most of them I’m able to avoid, but some of them just happen to hit my sweet spot: I had no problem avoiding smoking growing up, but world of warcraft consumed years of my adolescence.

Others don’t find world of warcraft addictive, instead procuring their poison elsewhere. Maybe it’s minecraft, or league of legends, or youtube shorts.

One of the reasons these apps out-compete the ‘real world’ is because they start competing for our attention at a very young age. Most kids will grow up inside of roblox, minecraft, discord, instagram, and tiktok. If a kid starts using their smartphone at 10, these platforms will have a full 8 years to solidify within their mind and modify their values and social network before they are even legally allowed to have a job. I refer to this concept as personality capture and have a post on personality capture and personality basins here.

Some comparisons to past historical figures:

- Andrew Carnegie started working at a cotton factory at the age of 12

- John Rockefeller got his first job as a bookkeeper at 16

- Benjamin Franklin began working at a print shop at age 12

- Henry Ford left home at 16 to work as an apprentice machinist

I would have killed for a tech internship when I was 14. I had no idea how I could do that, so I studied independently for my CCNA instead and would hop straight into video games when I got home. In hindsight it’s really interesting thinking about past-me playing these games, because I was young and knew so little about the world, yet my counterparty was hundreds or thousands of well-educated adults optimizing for my addiction and spend. It certainly wasn’t a fair battle!

Products induce strong preference modification

When I was 12, the highest-status person in the world to me was zezima. For the ~85% of readers who don’t recognize this name, he was the highest ranked player in runescape and had an aura of infamy that I can only compare to someone like elon musk. What I wanted most in life at this age was a party hat, which was an immensely valuable item in the game which most players could never afford even after years of play.

Many of our values are locally-set by our environment and peers, and when we immerse ourselves into a different world, our preferences change alongside it. This is pretty obvious – the twitter addict is constantly thinking about how many followers and likes they get just as the league of legends player is ever-ruminating over their rank and win ratio.

This is a fully general force too – If my friends and I only had a forest to play in growing up, we’d probably have invented some status game of who can climb the highest tree and would eventually have our own local culture, lexicon, and so on. But the forest is actually much easier to escape from than video games and social media – literally speaking.

I tried to find some user retention numbers for world of warcraft which I was heavily addicted to as a teenager and found a monthly churn of ~5%. In other words, the typical world of warcraft subscriber played the game for over a full year. I wonder if they knew when they clicked the sign up button that, statistically speaking, they would spend hundreds of dollars and over a year of their life playing? I certainly didn’t when I clicked the button at 13. It’s worth noting that the linked paper is a decade old and points to a time when we used spreadsheets to optimize addictiveness rather than machine learning.

That your preferences are locally induced is why the simple heuristic that you become the average of your five closest friends is so useful. If you get to choose your friends, you also get to choose many of your preferences and goals. Although I had the freedom to choose my friends at the time, quitting a game I loved was hard because unless my friends quit too, I’d have to go find new friends. Before this statement appears obviously fallacious to many readers, I need to add the necessary context that most people I knew in MMOs would also play them for ~100% of their free time, easily reacing 8-16 hours a day (yes, there’s a strong selection effect here). Although I had a ton of fun in my years inside these games, I always wondered what I’d have ended up doing if they hadn’t existed.

Agency in the free market

I’m writing this blog post at 1AM right now. In order to do so I’ve had to block twitter, close messenger, and set my phone to night mode. Luckily I’m not battling any video game or youtube shorts addictions, or this post wouldn’t exist. I don’t think I’d be able to sit down and write for hours if I had spent my entire adolescence on tiktok.

As consumer markets become more efficient and we become more skilled at capturing and retaining the attention of the populace, we should expect the average agency of society to decrease.

This is obvious if you think about it for a bit (the goal of almost every app on your phone is to get you to do less of anything which pattern matches ‘not using their app’), but there are few who appreciate the magnitude of this effect as the masses of society engrossed in video games and social media at home alone in their bedrooms every night are well-hidden from us. You can walk to the park to see 50 people enjoying the outdoors, but the millions currently scrolling tiktok at home are hidden from you in every way except via a statistic.

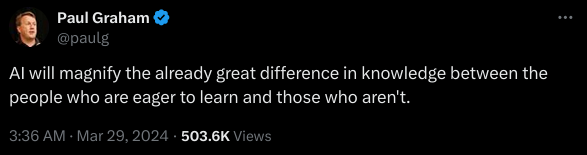

I love how easy generative AI makes it to learn – I sometimes talk to Claude until I’m exhausted and have to sleep. But in the free market, Claude doesn’t stand a chance against Tiktok. This post isn’t about Tiktok either though, as Tiktok doesn’t stand a chance against SuperTiktok (soon).

Outlier Success

Many have wondered why there’s fewer entrepreneurs in their 20s on a path to outlier success than there were in previous decades. Facebook IPO’d at a valuation of $104 billion when Mark was 28. Stripe reached a valuation of $35 billion when John was 29. Snapchat IPO’d at $24 billion when Evan was 25. These are outlier examples, but that’s the entire point. Where are the current outlier examples from the next generation?

I offer several potential answers:

- They are currently busy playing video games (which likely become more important to them at a very young age)

- They watched so much tiktok as a adolescent that they no longer have the attention span to build things (that would involve not using tiktok)

- They have so little free time due to attention economics that they no longer have original ideas (time spent doing ‘nothing’ is very valuable for quality long-term life outcomes)

Many in the tech ecosystem call me a doomer when I suggest these explanations – they certainly aren’t addicted to video games, and their friends certainly don’t have reduced attention spans from tiktok. But they live in a bubble within a bubble (context: I work in AI in San Francisco), and from my point of view the data points to these hypotheses as strong contenders. Sometimes I talk about this with normal people and they think the above is so obvious that it doesn’t even interest them. Perhaps our future has always been that of bread and circuses?

To clarify – I don’t intend to say that consumption or video games are bad; I love both of them myself! But we may be getting too good at consumer app optimization, and when that is paired with adoption at a young enough age, the outcome is undesirable. Building minecraft inside of minecraft is cool, but when I see a toddler scrolling youtube shorts on an ipad alone I feel really bad.

As the agency of the average consumer decreases, the ceiling for the agency of outliers increases. Examples of inventions which drastically increased the ceiling of agency include venture capital, generative AI, programming, microchips, and trade and capitalism itself. Once AI agents start to actually work it seems like this will be another large driving force here. Many have wondered when the first one-person billion-dollar company will exist, and many predict it may be within just one or two decades. It will be an interesting time to be alive in, if nothing else.

If you enjoyed this post, you may also enjoy: Types Of Memetic Information and my Home Page.